Consumer Duty Leadership Awards 2024 winner, Cardiff & Vale Credit Union is transforming its digital platform to support customers.

The FCA’s Consumer Duty is a set of rules developed to create a higher standard of consumer protection. It has been designed to ensure that firms put customers at the heart of their business, provide products and services that meet their needs, and provide fair and equitable customer journeys.

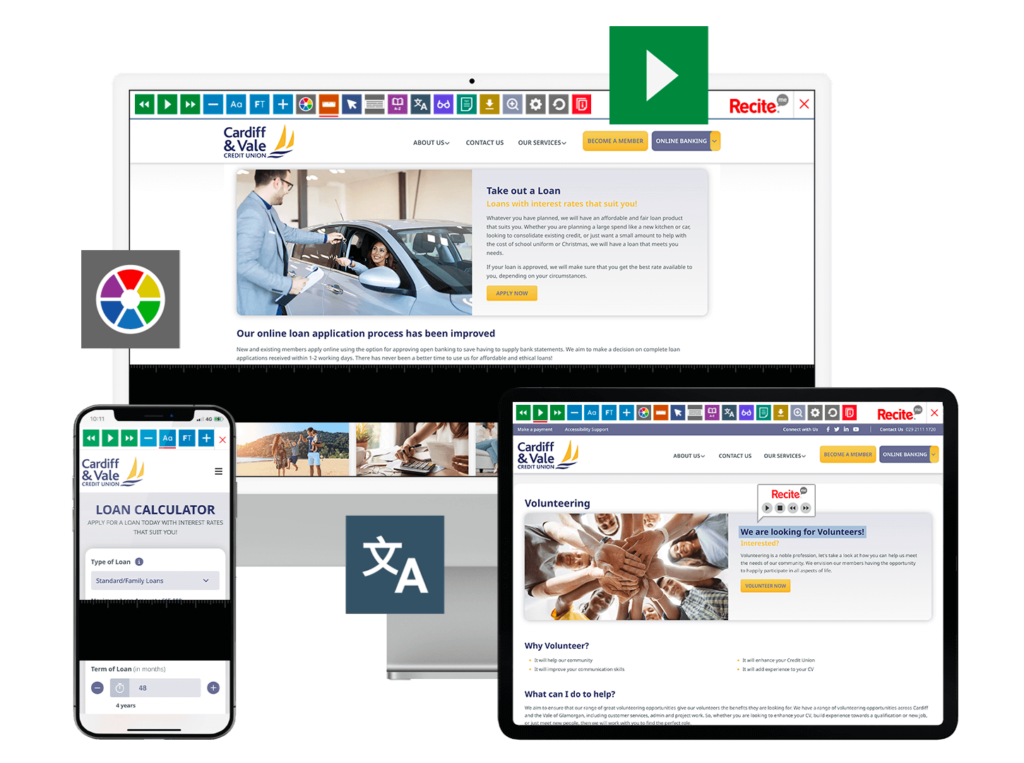

As part of this mission, Cardiff & Vale Credit Union has adopted Recite Me assistive technology to give customers full customisation of their website so that they can read and understand content in a way that suits their individual needs.

We caught up with Caroline Richardson, CEO, and Llinos Jonathan, Board Member and Consumer Duty Champion at Cardiff & Vale Credit Union, to discuss the importance of Consumer Duty, the actions they took to win this award, and how Recite Me has helped.

Why is the consumer duty important to organisations in the finance sector?

The UK Financial Regulator (the Financial Conduct Authority) requires all firms in the financial sector to adhere to the newly introduced Consumer Duty Regulations. The Duty sets high consumer protection standards across financial services and requires firms to put their customers’ needs first. Firms are required to comply with the Duty’s cross-cutting rules by acting in good faith towards customers, avoiding causing foreseeable harm to customers and enabling and supporting customers to pursue their financial objectives. In essence, it means that consumers should:

- Have the support they need, when they need it

- communications they understand

- products and services that meet their needs and offer fair value

This is specifically important within the finance sector due to its complicated nature. Financial information can provoke confusion and stress; therefore, we find that there are more likely to be a large amount of vulnerable customers. This emphasises just how important Consumer Duty is, so we can protect these customers.

What did the roadmap look like for you to achieve this award? What accessibility adjustments were put in place to win?

We realised very early in the process that in order to achieve a better, faster and more efficient service for our customers we needed to implement new software, such as a new mobile app to make accessibility easier for those who struggle navigating the digital world. The new software enabled us to identify our most vulnerable consumers and help support them with more personalised support. To enable this Staff underwent 13 training sessions on key aspects of the Duty.

In addition, we needed to improve our communications platforms, so information was more accessible and easier to understand. Our website was re-launched with simpler navigation, plain language and a financial wellbeing section. Social media posts became more straightforward and helpful and regularly contained information about Financial Wellness. Over 70 Member Service and Credit Control letters were reviewed to provide clearer wording and updated contacts.

Are there any tips you would tell organisations that want to follow in your footsteps?

It is important to be proportionate about the implementation of the Duty. The FCA want smaller firms to feel confident about the Regulation and take an approach that fits their size, activities and market. Whilst initially it is useful to focus on the individual outcomes required by the Regulator, ultimately the Duty needs to be viewed holistically, where we think about the “end–to–end “consumer journey. It is important to identify what makes a good consumer experience. Finally, using data and consumer feedback to help us maintain continuous improvement in everything we do is a vital component

What was the reason for seeking out assistive technology on your website?

Applying for financial support is often daunting and we know that many of our consumers have vulnerabilities and that we live amidst so many diverse communities. The Consumer Duty requires us to provide effective and understandable communication for all consumers, and as a Credit Union, we seek to help consumers when they need it most. Therefore, we want them to have as good an understanding of our products and services as possible so that they can reach their financial goals easily and more effectively.

Whilst we have already actioned many new initiatives as part of the Duty and we are committed to continually improving and helping our consumer base so they all get as good an experience as possible, in what are often challenging times for them.

Are there any examples of Recite Me helping you to fulfil the consumer duty regulations?

Yes – improving accessibility for those with infirmities and social exclusion together with increasing comprehension and understanding for those whose first language is not English. We have already found in the early stages of Recite Me that our web pages have been translated over 170 times.

How does offering a more inclusive and accessible website help set your customers up for financial success?

Offering easier accessibility and increased inclusivity means that we can cater for a wider community that may be challenged by infirmities, vulnerabilities or language barriers. We want all our consumers to have a very clear understanding of our products and services so they are well informed and can make the best decisions for their financial needs.

Accessibility is a big part of the Cardiff and Vale Credit Union ethos, as we encourage inclusivity and stress the importance of community. We believe that important information (such as financials) should be easily accessed and not buried in overwhelming jargon. Recite Me has been a vital tool in our Consumer Duty journey.

Kickstart your accessibility journey with Recite Me

Act today to ensure your website is accessible and compliant with the latest WCAG standards. Get started on your website accessibility strategy by working through the following action points:

- Contact our team for more advice about WCAG standards and Accessibility best practices.

- Find out more about the Recite Me Web Accessibility Checker.

- Schedule a free demonstration to learn how our technology can help you.

- Run a free scan of your website for WCAG 2.1 AA compliance.

- Try our assistive toolbar on your website.